sales tax on food in chattanooga tn

What is the sales tax rate in Chattanooga Tennessee. View More Data.

Sonic Drive In Home Chattanooga Tennessee Menu Prices Restaurant Reviews Facebook

Did South Dakota v.

. This tax is generally applied to the retail sales of any business organization or person engaged. - Single standard deduction one exemption - Sales Tax includes food and services where applicable - Real tax taxes are based on the local median home price - Car taxes assume a new Honda Accord costing 25000. Visit wwwtngovrevenue and click Revenue Help baby food bottled water.

Chattanooga Tennessee and Tampa Florida. The County sales tax rate is. You can print a 925 sales tax table here.

House located at 1027 Floyd Dr Chattanooga TN 37412 sold for 65000 on Aug 28 2001. The Tennessee sales tax rate is currently. 05 lower than the maximum sales tax in TN.

Clarksville TN Sales Tax. 67-6-102 67-6-202 Sales or Use Tax The sales or use tax is a combination of a state tax 7 and a local option tax which varies from 150 to 275 imposed by city andor county governments. APN 169L C 022.

The 925 sales tax rate in Chattanooga consists of 7 Tennessee state sales tax and 225 Hamilton County sales tax. Food City Governor Bill Lee Grocery inflation local food taxes. The December 2020 total local sales tax rate was also 9250.

There is no applicable city tax or special tax. The minimum combined 2022 sales tax rate for Chattanooga Tennessee is. The Chattanooga sales tax rate is.

The current total local sales tax rate in Chattanooga TN is 9250. View sales history tax history home value estimates and overhead views. In the state of Tennessee sales tax is legally required to be collected from all tangible physical products being sold to a consumer.

This is the total of state county and city sales tax rates. 2022 Cost of Living Calculator for Taxes. Lee Proposes Suspension of Grocery Sales Tax in Tennessee State tax would be withheld for 30 days.

Job in Chattanooga - Hamilton County - TN Tennessee - USA 37404. Real property tax on median home. Several examples of of items that exempt from Tennessee sales tax are medical supplies certain groceries and food items and items used in packaging.

You can also email revenuesupporttngov or call 615-253-0600 with any questions. 31 rows Chattanooga TN Sales Tax Rate. The ladies shot 307 on Monday for a 2.

9 hours agoThe Chattanooga Mocs womens golf team boasts three in the top 20 heading to Tuesdays final round of the Chattanooga Classic at Council Fire Golf Club. Prepared food candy dietary supplements tobacco alcoholic beverages are taxed at 7 plus local sales tax rate. RE trans fee on median home over 13 yrs Auto sales taxes amortized over 6 years Annual Vehicle Property Taxes on 25K Car.

This means that an individual in the state of Tennessee who. Sales or Use Tax Tenn. Sales Tax State Local Sales Tax on Food.

Thanks to the IMPROVE Act the state sales tax rate on food and food ingredients has been reduced 20 from 5 to 4 plus local sales tax rate.

Chattanooga Tennessee Wikiwand

Your Weekend Guide To Chattanooga Tennessee

Chattanooga Market Tennessee Vacation Chattanooga Market Downtown Chattanooga Chattanooga

Bea S Restaurant Chattanooga Restaurants Chattanooga Restaurant

Dinner On The Diner 2 Hours Dinner Train Chattanooga Train Rides

Pin On Good Food In Knoxville And Chattanooga

Chattanooga Tennessee Wikiwand

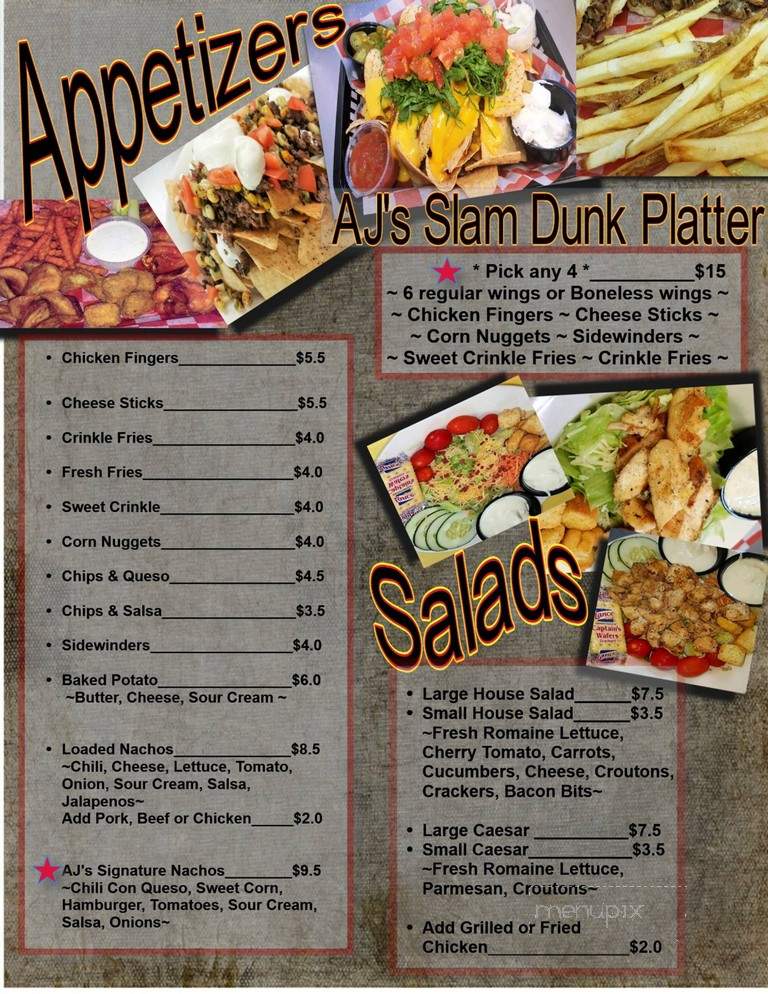

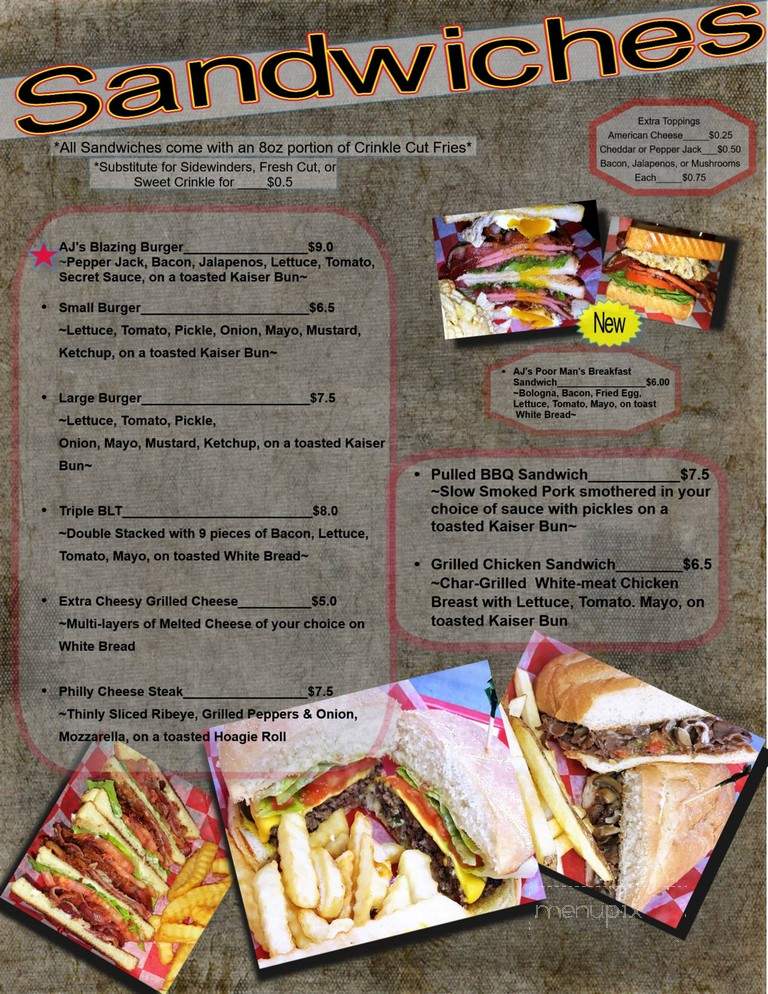

Menu Of Aj S Sports Bar And Grill In Chattanooga Tn 37416

Menu Of Aj S Sports Bar And Grill In Chattanooga Tn 37416

Chattanooga Vs Knoxville Comparison Pros Cons Which City Is Better For You

Apple Spice Box Lunch Catering Chattanooga Tn Menu In Chattanooga Tennessee Usa

Chattanooga Convention Center Downtown Chattanooga Chattanooga Outdoor Magazine

I 24 Monteagle Mountain Remember This My Dads Home Beautiful Places East Tennessee House Dad

Tupelo Honey Chattanooga Restaurant Chattanooga Tn Opentable

Menu Of Aj S Sports Bar And Grill In Chattanooga Tn 37416

21 Pros And Cons Of Living In Chattanooga Tennessee Retirepedia